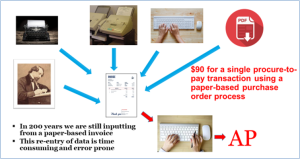

Two hundred years ago invoices were prepared by a quill pen and sent by the supplier to the customer to be manually entered, by quill pen into the books. As Exhibit 1.1 shows this was improved with the advent of the typewriter, computer, fax machine. Now invoices can arrive automatically from the supplier’s accounting system in the form of a readable PDF.

The problem is that many accounts payable teams are then re-entering an electronic transaction. A classic wasteful process. This means for many accounts payable functions the cost from procurement to paying is costing as much as $90 per transaction.*

* 2017 study of 3400 respondents covering 20 major US and Canadian banks

Exhibit 1.1 The manual intervention waste in Accounts payable

The situation is further exacerbated by:

- 80% of organisations being unable to take advantage of discounts (2014 study)

- Time spent searching for lost or misplaced invoices

- The sending of processing offshore that never was an answer in the first place

- Regular material unrecorded liabilities

- Undetected fraud

Checklist of the 50+ ways to improve AP an extract from 50+ Ways To Improve Accounts Payable – Toolkit (70 page Whitepaper + e-templates)

Accounts payable systems improvements easy steps |

|

| § Purchase an electronic ordering system (procurement system) which automatically links with the accounts payable system so that orders are completed electronically and invoices are matched electronically | |

| § Load remittances electronically onto your website in a secure area so that suppliers with their password can download them. This removes the need to post remittances to suppliers. One participant said this was set up very easily by the IT team. | |

| § Acquire an integrated web based expense claim system so staff can complete their expense wherever they are in the world. | |

| § Acquire a web-based purchase card and ensure wide spread use (see later section). | |

| § Update system to allow a screen enquiry to check payment history with the most recent payment showing at the top of the display. | |

| § Put receiving documentation on-line, eliminating the need to forward them to accounts payable. | |

| § Get your IT team to meet with your major supplier’s IT team so that invoices can be received electronically already with your GL codes!! | |

Accounts payable systems improvements more integrated steps |

|

| § Major suppliers are required to provide transactions through electronic data interchange (EDI) | |

| § A workflow software, often not part of the G/L suite, matches transactions to receipting and to the purchase order | |

| § All major suppliers will have read only access so they can track where their invoice is in the system and when it will be paid |

Administration improvements for all AP teams |

|

| § Set up account management within your AP team type of supplier, rather than letter of the alphabet e.g. instead of Pat doing A-H suppliers, Pat works on all builders’ accounts | |

| § Route invoices directly to accounts payable by setting up a new email e.g. accounts payable@___________ | |

| § Write a procedures manual and load it on the Intranet, covering ordering, approving, delegated authorities, expense claims, frequently asked questions etc. update quarterly for undocumented procedures. | |

| § Develop a quick form for credits, charge backs, so that staff can immediately return goods which have not been ordered or do not meet specification to the supplier. One copy goes to the supplier, one copy retained by the issuing team, one copy going to AP. | |

| § Reduce the number of G/L codes. Particularly in expenses. Many companies manage successfully with as little as 100 P&L account codes. The more G/L expense codes you have the more coding errors you may have. | |

| § Ensure the mail room returns all hard copy invoices to the suppliers with standard letter. | |

| § Introduce scrum to the AP team | |

| § Introduce a Kanban Board to the AP team | |

Administration improvements for AP teams without procurement or electronic ordering systems |

|

| § Replace a voucher control document with a stamp that goes directly on the invoice. It contains spaces where required information, such as voucher number, supplier number etc., can be filled in. | |

Month-end AP procedures |

|

| § Cut-off accounts payable at noon day-1 | |

| § Cut-off budget holders’ accruals at 5pm day-2 | |

| § Limit budget holders’ accruals to material amounts only e.g. no accrual JV for less than $xxx, no one item on the accrual for less than $xxx | |

| § Stop reconciling to suppliers’ statements | |

| § Avoid inter-company adjustments | |

Staffing improvements |

|

| § Consolidate purchasing and accounts payable into a single work unit under one manager. | |

| § Educate and train staff to use brainstorming techniques when tackling a processing problem. | |

| § Improve recruitment by using simulation and psychometric testing for the short-listed candidates. | |

| § All new AP staff to have a financial and/or accounting background e.g. they understand how a general ledger works and know their debits and credits | |

| § Add a position of “compliance specialist” to the accounts payable department. This person’s only responsibility is to review “suspicious” invoices, billing patterns, etc. The position requires good analytical skills and the ability to use spreadsheets and intimate knowledge of the accounting software used. | |

| § Allow some time each month for your experienced AP staff to research innovation, suggested minimum is four hours a month per staff member. | |

| § Have an off site accounts payable staff goal setting meeting, twice a year. | |

Business re-engineering |

|

| § Stand back and take an overview of the whole department and the tasks each staff member is performing. This will enable you to identify duplicate efforts and realign responsibilities that should be grouped together. | |

| § Eliminate redundant steps in the invoice-approval process. | |

| § Measure the accounts payables accuracy rate of processing invoices in a set week each month, say third week (this makes measurement easier). Investigate reasons and implement training, and other remedial action. | |

| § Record the budget holders who have the most late invoices, invoices without orders, and publish results on the accounts payable intranet page | |

| § Measure the payables accuracy turnaround time for processing expense claims based on a random sample of ten expense claims (this makes measurement easier). | |

| § Use post-it re-engineering to identify and eliminate non-value steps. | |

Payments improvements |

|

| § Get rid of the cheque book – make all payments electronically to both suppliers and employees. | |

| § If some suppliers insist on being paid by cheque, either cease doing business with them, or pay them once every six weeks in the six weekly cheque run. | |

| § Perform frequent direct credit payment runs, better practice is to do these daily (this does not mean you are paying earlier as you still stipulate the future payment date). | |

| § Develop and stick to tough procedures for rush payments. | |

| § Use a contractor/student to ring suppliers to get direct credit details by reading from a preprepared script e.g. “We are sorry we cannot pay you this month….pause…..we are a modern company and we have thrown away the cheque book.” | |

| § Self-invoice (buyer created invoice) for all those frequent suppliers whose systems are inefficient, this works particularly well where the amount invoice is based on the weight that passes over your company’s weigh-bridge. | |

Improving relationship with budget holders |

|

| § Establish account management within the accounts payable team e.g. Sarah looks after budget holders A, B and C, Ted looks after budget holders D, E and F. | |

| § Implement procedures to train professionals in other departments as to accounts payables processes and requirements. | |

| § Hold training classes to ensure employees know how to use current processes and procedures. | |

| § Send a “welcome letter” to new employees to train them from the beginning and eliminate problems and bad habits before they have a chance to start. | |

| § Develop a site-wide presentation of about 30 minutes outlining how the accounts payable function operates. Cover invoice approvals, completion of expense reports, etc. Require all managers and staff to attend. | |

| § Make departments aware of all their errors. Set up a system to input vouchers as they are coded and send incorrect data to a report called “error suspense.” Distribute copies of this report to the appropriate departments so they may fix their errors. | |

| § Set a strict schedule for receiving invoices for payment. Distribute the schedule to all affected parties within the company and stick to it firmly. | |

Improving relationships with suppliers |

|

| § Acquire a warehousing facility so that suppliers can rent space and leave their consignment stock. | |

| § Ask for consolidated invoices from suppliers especially utilities, stationery. Some “monthly invoice” suppliers in this new environment can be encouraged to invoice on a new cycle, e.g. invoice cycle including transactions from 26th May to 25th June and being received by the 28th of the month. The accruals can then be a standard four or five business days depending the remaining working days of the month. | |

| § Change invoicing cycles on all monthly accounts such as utilities, credit cards etc. to a 26th May -25th June sequence (see below for more detail). | |

| § Ask major suppliers to request an order from your budget holders – support this by not paying the supplier invoices unless there is a purchase order. Simply return to supplier and ask them to attach the purchase order details (they will not want to repeat this activity more than once!). | |

| § Ask large-volume small-dollar suppliers to either invoice monthly or accept your purchase card. | |

| § Create more national contracts which give you the ability to negotiate better deals and transfer processing to them. E.g, have one stationery supplier | |

| § Have one stationery supplier and introduce consignment stationery cupboards on all floors in the organization. Staff then can take out what stationery they need. The stationer simply invoices you monthly, in a consolidated invoice, sent electronically with floor- by- floor usage. To control usage you simply chart usage and compare average usage per employee per floor. | |

| § All new suppliers to agree to receive direct credit payments. | |

| § Ask suppliers who provide services to different branches to provide a consolidated invoice covering all branches e.g. one telecommunications account for the company. | |

| § Develop an on-line supplier contact database. Anyone dealing with a particular supplier should be able to access this program. Each person with such dealings with a supplier keeps the file updated as to the current status of their transactions for all to see. | |

Identify accounts payable fraud early |

|

| § Implement the 5 basic searches for duplicate payments | |

| § Look at invoices that start with a number 5 to 9 | |

| § Suppliers’ invoices with higher percentage of rounded amounts | |

| § Supplier invoices that are just below approval amounts | |

| § Uncleared cheque numbers (if still using a cheque book) | |

| § Abnormal invoice volume activity | |

| § Above average size of payments | |

| § Vendor / employee cross-check |

Look inside the contents page of the AP toolkit

1.1 The waste in accounts payable activities 4

1.2 How far have we progressed in the last 200 years?. 5

- The impact of better practices on the accounts payable workload. 7

- The easy administration improvements to Accounts Payable. 8

3.1 Limit your account codes for the P/L to less than 60. 9

3.2 Introduce scrum to the AP team.. 9

3.3 Introduce a Kanban Board to the AP team.. 11

3.4 Applying Kaizen to all accounts payable team processes 12

4.1 Throw away the company cheque book. 13

4.2 Mount the last cheque signed in the CEO’s office. 14

4.3 Use self-generated invoices (Buyer created invoices) 14

6.1 One office stationery supplier 19

7.1 Cut-off AP on the last working day. 21

7.2 Closing accruals on Day -2. 21

7.3 Stop reconciling to suppliers’ statements 22

7.4 Avoid inter-company adjustments 22

7.5 Benefits of quick monthly reporting. 22

8.1 Electronic data interchange. 27

8.3 Travel and expense systems – travel, hotel hire car 27

8.4 Review of software solutions 28

8.6 Get your electronic ordering system to work. 30

- Administration improvements for all AP teams 32

- Staffing improvements within accounts payable. 32

- Improving relationships with budget holders 33

11.1 Send a welcome letter to all new budget holders 33

11.2 Introduce “shame and name” lists 34

11.3 Increase budget holder turnaround on approving invoicing. 34

12.1 Look for duplicate payments 35

12.2 Look at invoices that start with a number 5 to 9 (Benford’s Law) 37

12.3 Suppliers’ invoices with higher percentage of rounded amounts 38

12.4 Supplier invoices that are just below approval amounts 38

12.5 Uncleared cheque numbers (if still using a cheque book) 38

12.6 Abnormal invoice volume activity. 39

12.7 Above average size of payments 39

12.8 Vendor / employee cross-check. 40

- How to workshop month-end process improvement with ‘Post-its’ 40

- Writer’s biography. 42

- Appendix 1 Checklist of the 50+ ways to improve AP. 43

- Appendix 2 Checklist of steps to reduce m/e time frames 49

- Appendix 3 Useful letters 52

- Appendix 4 Paperless at IBM and Johnson & Johnson. 58

- Appendix 5 Email to suppliers to make all invoices paperless 64

- Appendix 6 “Post-it” re-engineering workshop to speed up month-end reporting. 65