Building a High Performing Finance Team

Imagine your Finance team making history rather than just reporting on it. Imagine your month-end reporting being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

I have written a series of toolkits (extensive whitepapers 70 to 100 pages+ electronic templates) that help solve many issues. These contain my latest work. For snippets into these toolkits visit some of these pieces:

- 15 Steps to a Faster, Better Close

- 10 one page reports that Finance teams need to use

- Nine Lessons When Implementing a Quarterly Rolling Forecast on a Planning Tool

- Quarterly Rolling Forecasting – the 14 foundation stones

- The ten things wrong with board reporting packs

- The 10 rules for reporting a finance team need to follow

- 10 strategies for optimizing your accounts payable

Common problems in the finance team

Are your month-ends one drama after another Read more. Is your organisation succeeding in spite of the annual planning process rather than because of it? Read more Is the finance team a collection of individuals rather than a cohesive team? Read more Is the year-end a process that carries on months into the new year? Read more Does the finance team have a history of late and/ or failed projects? Read more Do you have too many KPIs, many of which are leading to dysfunctional behavior? Read more. Are the accountants spending too much time reporting history rather than making it? Read more.Some of the Published Articles & Chapter Extracts

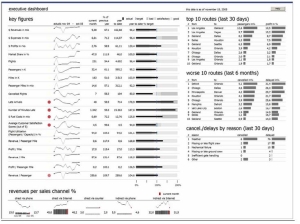

- One page executive report using spark-lines and bullet graphs

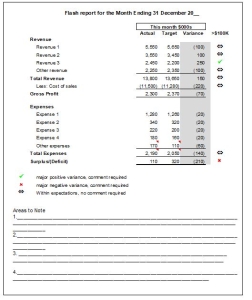

- One page flash report of month-end summary numbers to the CEO by 5pm first working day

- One page finance report to the CEO on an A3 (Fanfold) page

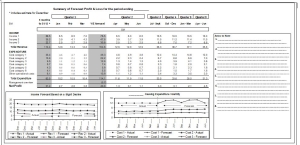

- One page Profit & Loss forecast on an A3 (Fanfold) page

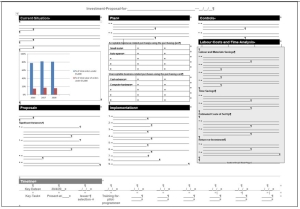

- One page investment proposal on an A3 (Fanfold) page

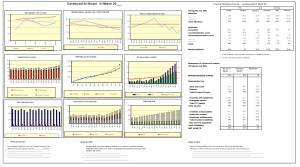

- One page Board Dashboard on an A3 (Fanfold) page

- One page daily report on a KPI

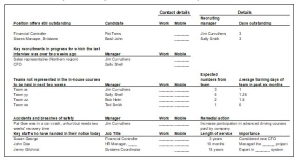

- One page daily report on HR issues

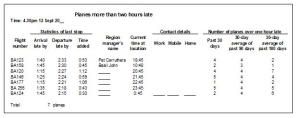

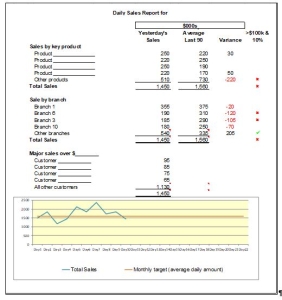

- One page Yesterday’s daily sales report

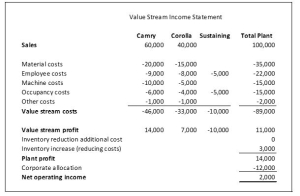

- One page value stream reporting

- Allowing month-end reporting to go past three working days

- Taking months doing an annual plan – when it can be done in 10 working days

- Letting Excel dominate the finance system

- Not investing enough in accounts payable.

- Not adopting the purchasing card (a free, accounts payable system)

- Investing in a complex G/L and then upgrading it too frequently

- Having over 80 account codes for the P/L

- Budgeting at account code level

- Breaking down the annual plan into twelve before the year starts

- Giving budget holders an annual funding entitlement

- Only forecasting to year-end

- Not producing daily/ weekly decision based reports

- Producing numbing monthly financial reports

- Reporting on the wrong performance measures which can damage performance

- Selling change by logic instead of the emotional drivers of the buyer

- Using Julius Caesar’s calendar instead of 4,4,5-week months each quarter

- Spending months on the annual accounts

- Working hard but not smart

- Holding onto time wasting habits

- Not investing enough time to attract and recruit talented staff

10 one page reports that Finance teams need to use

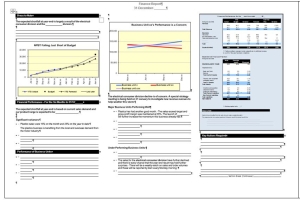

(extract from One-Page Finance Team Reporting Templates (90 page Whitepaper + electronic templates)

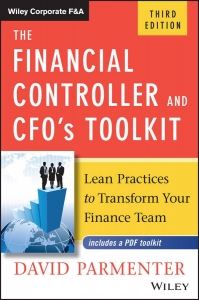

Look inside the breakthrough lean finance team book

Chapter 3: Rapid month-end reporting from ‘The Financial Controller and CFO’s Toolkit’ 3rd edition

3: Rapid month-end reporting from ‘The Financial Controller and CFO’s Toolkit’ 3rd edition

Chapter 14: Recruiting from ‘The Financial Controller and CFO’s Toolkit’ 3rd edition

Chapter 16: Quarterly rolling forecasting from ‘The Financial Controller and CFO’s Toolkit’ 3rd edition

Chapter 20: Performance Bonus Schemes from ‘The Financial Controller and CFO’s Toolkit’ 3rd edition

A look inside the book – a 25 page extract

Testimonials on The Financial Controller and CFO’s Toolkit 3rd edition

The Financial Controllers and CFO’s Toolkit 3 rd Edition. is a follow-on from Winning CFOs and Pareto’s 80/20 for Corporate Accountants.

|

|

|

| Click here to read more about the book | This was the second book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition | This was the first book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition |

I teach how to develop winning KPIs, replace the annual planning process with quarterly rolling planning, speed up accounting processes and winning leadership. I’ve delivered workshops and key note addresses in 32 countries. Companies where I have delivered in-house workshops include European Space Agency, Australian Post, Lloyds of London, Open University, and the Singapore government (Peoples Association) and more.

How to avoid the twenty major mistakes corporate accountants commonly make every year

The fixes are covered in ‘How to avoid the twenty major mistakes corporate accountants commonly make every year – Toolkit (110 page Whitepaper + e-templates)’

Accessing David Parmenter’s intellectual property

David Parmenter’s Toolkits with E-Templates

If you want to access the latest thoughts of David Parmenter, buy one of his nine toolkits or his Finance Function package deal. His toolkits are constantly updated and are a comprehensive (100 page) guide to get you to make change in the areas covered. Each toolkit comes with accompanying electronic templates to get your implementation started. On time of acquisition David reviews and updates the tookit as appropriate. These toolkits are printed, signed and posted to the purchaser.

David Parmenter’s Mini-Toolkits

For areas which are not covered by a toolkit I have written a shorter (20- 30 pages) Mini-Toolkits to help you make progress. They can be read and absorbed in an hour. All you need to do is purchase them via the PayPal link and the working guides are emailed with accompanying useful E-templates with 48 hours. To buy multiple guides access the special deal.

As a sample I have given you two FREE working guides. The accompanying Etemplates can be purchased from:

Lean One Page Reporting for the Finance Team

Innovation: How the Millennial Manager can unleash its potential

E-Templates From David Parmenter’s Financial Controllers and CFO’s Toolkit

You can purchase all the electronic versions of the book templates. Once the PayPal notification has been received the templates are emailed with 48 hours..

David Parmenter’s Performance Measures Database (known as a KPI database)

The database, developed over the last twenty years, and regularly updated, is sent in both Access and Excel.

Interview with David Parmenter while on his ‘Winning CFOs speaking tour’

Mastering the traits of a winning CFO

Never before has the role of the CFO been more complex, multi-faceted and rewarding. The CFO is now juggling more balls in the air than ever before, in front of an audience that is more demanding and knowledgeable.

What makes the difference from average to good and from good to great performance?

In this article I will attempt to shed some light on why you may not be scoring the goals you should, save training drills and suggestions. Please note that I am not writing this from personal success. I have never been a CFO, nor was I a good corporate accountant. I am basing this article on countless years of benchmarking CFO’s from all sectors and whose success varied from poor to great.

The CFO is now juggling more balls in the air than ever before, in front of an audience that is more demanding and knowledgeable. What makes the difference from average to good and from good to great CFO performance? I believe I have the answer. The model I have developed is based on countless years of bench marking CFO’s from all sectors and whose success varied from poor to great.

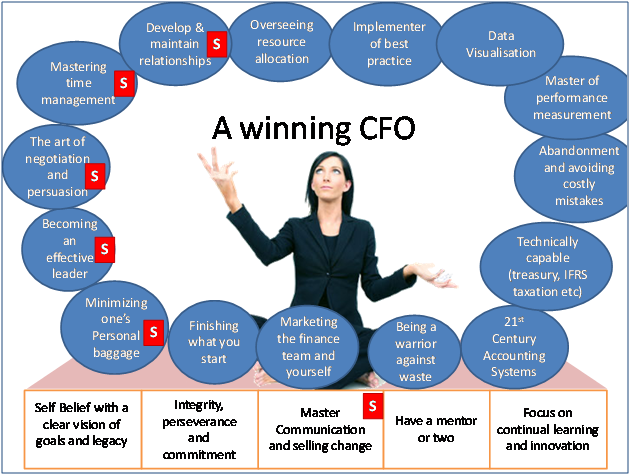

Once the foundation stones in place, you can now use them as a platform from which to juggle the areas of focus, see Exhibit 1, that make up being a winning CFO. Many of the focus areas have a soft skills component, an area which is often not on the CFOs radar screen. These have been marked with an ‘S’.

Exhibit 1 A winning CFO model

To continue reading please view Mastering the traits of a winning CFO here.

I have developed much material to help revolutionize the CFO performance: